Day Care Providers Enjoy Special Tax Benefits

- Mariko Hayashi-Hall

- Jul 28, 2022

- 4 min read

Article Highlights:

A taxpayer who is in the business of providing family daycare in their home may deduct the ordinary and necessary expenses of their business. The two primary deductions include the business use of their home and the cost of providing meals and snacks to children in their care. The following is a rundown on deductible business expenses for home daycare providers.

Business Use of the Home

Generally, to take a deduction for business use of the home, the tax law requires the business portion to be used exclusively for business. However, a special allowance is carved out for daycare facilities, allowing prorated use even though the business is operated in parts of the home also used personally by the care provider and his or her family. But that exception to the exclusive use requirement applies only if the owner or the operator of the daycare facility:

Has applied for (and the application has not been rejected) a license, certification, registration, or approval as a daycare center or a family or group care home under the provisions of any applicable state law;

Has been granted (and the grant has not been revoked) a license, certification, registration, or approval as a daycare center or a family or group daycare home under the provisions of any applicable state law; or

Is exempt from having a license, certification, registration, or approval as a daycare center or a family or group daycare home under the provisions of any applicable state law.

The daycare facility exception does not apply if the services performed are primarily educational or instructional in nature (e.g., musical instruction). However, the exception does apply if the services are primarily custodial and if the educational, development, or enrichment activities are only incidental to the custodial services. The determination generally depends on the facts and circumstances of each particular case.

When calculating the percentage of business use of the home, both the space used to operate the daycare business and the amount of time that space is used to provide daycare – including preparation and cleaning time – are factors.

Example: Edna uses her living room, kitchen, and bathroom ten hours a day, five days a week, to provide licensed daycare services. The home is 2,400 square feet, and the living room, kitchen, and bathroom are a combined 1,400 square feet. Edna’s percentage use of her home for a business is determined as follows:

1,400 X 10 X 5 = .1736 or 17.36%

2,400 24 7

Although the business use of the home deduction cannot exceed the gross income of the business, and there is an order in which the deductions are allowed while applying the gross income limitation, the deduction is generally made up of the following prorated expenses:

For an Owned Home:

Mortgage interest

Home taxes

Utilities

Repairs

Homeowner’s insurance

Depreciation

For a Rented Home:

Rent

Utilities

Repairs

Renter’s insurance

Example: Edna, in our prior example, provides family daycare services out of her rented home, for which she pays $2,200 a month in rent and $3,100 for utilities for the year. Her business use of the home deduction is determined as follows:

Rent ($2,200 x 12)................ $26,400

Utilities.......................................3,100

Total.......................................$29,500

The prorated amount (her deduction for the year) is $5,121 (17.36% of $29,500)

Some providers have playrooms or sleeping rooms set aside that are used exclusively for their business. In these cases, a separate calculation for the exclusive-use space should be made using 100% use. Then that amount should be added to the deduction for the prorated portion of the home.

Deduction for Meals

Family daycare providers are allowed to deduct the cost of meals provided to the children in their care. However, separating the cost of food between those used for daycare versus personal use can be a record-keeping nightmare.

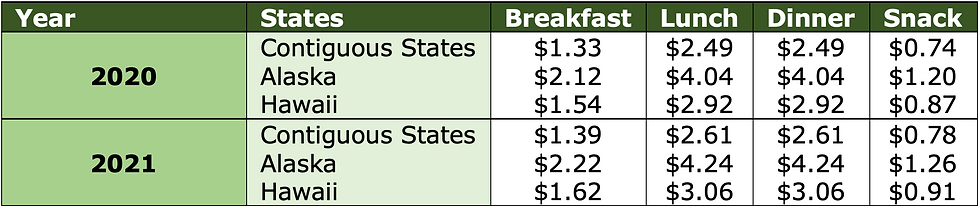

To minimize disputes with family care providers about the amount of their meal deduction and the quality of their substantiation, IRS will allow them to use the standard meal and snack rates to compute the deductible cost of food instead of deducting actual costs. Recordkeeping is also simplified if standard rates are used. The simplified deduction for each meal and snack bought and served to an eligible child during daycare equals the US Department of Agriculture's Tier I Child and Adult Food Care Program’s (CAFCP’s) reimbursement rates for meals and snacks served in daycare homes.

The rates are adjusted annually:

Simplified Meal Deduction – Family Care Providers

The rates do not include the cost of non-food supplies (e.g., utensils, paper napkins, and paper towels), which may be deducted separately. The number of meals per day per child is limited to a maximum of one breakfast, one lunch, one dinner, and three snacks. The following is an example of the daily maximum allowance in the contiguous states (the maximum for Alaska and Hawaii will be higher).

If the provider receives some form of reimbursement or subsidy, they can deduct only the part of the simplified rate that exceeds the reimbursed amount.

The rates may be used only by taxpayers (whether or not they are licensed, registered, or otherwise regulated) providing care in their homes to unemancipated children, and only concerning children for whom they are paid to care and who don't reside in the home.

Family daycare providers who use the simplified rates must deduct meals and snacks for the entire tax year. Still, the providers can switch to deducting actual substantiated amounts in another tax year.

Family daycare providers using the standard rates must keep records substantiating their computation of the total deductible amount. The records should include the name of each eligible child, the dates and hours of their attendance in the family daycare, and the type and quantity of meals and snacks served. Several commercially available software programs can maintain the required records.

Other Deductions

Other deductions, if adequately substantiated, can include:

Toys and games

Computer and software

Toilet supplies and diapers

Auto expenses for travel for field trips and business

Licenses and permits

Recordkeeping supplies

Wages paid to helpers

Personal protective equipment related to COVID-19

Cleaning supplies

Other related expenses

As you can see, the record-keeping and tax side of providing family daycare can be daunting. If you have questions related to recordkeeping and tax-filing issues, please call this office.

Opmerkingen